Introduction

The global textile trade is evolving rapidly, and 2025 is shaping up to be a significant year for exporters. With changing tariff structures, shifting trade policies, and new sustainability regulations, understanding textile export tariffs has become more important than ever.

As one of the leading textile manufacturers and exporters in India, More Textiles has been at the forefront of this dynamic industry — supplying premium-quality rugs, cushion covers, macramé products, and home décor items worldwide. This guide by More Textiles will help you navigate tariff changes, understand their impact, and plan strategically for your export business.

⸻

What Are Textile Export Tariffs?

Textile export tariffs are taxes or duties imposed by governments on textile products that are sold internationally. These tariffs affect product pricing, competitiveness, and profit margins for exporters like More Textiles.

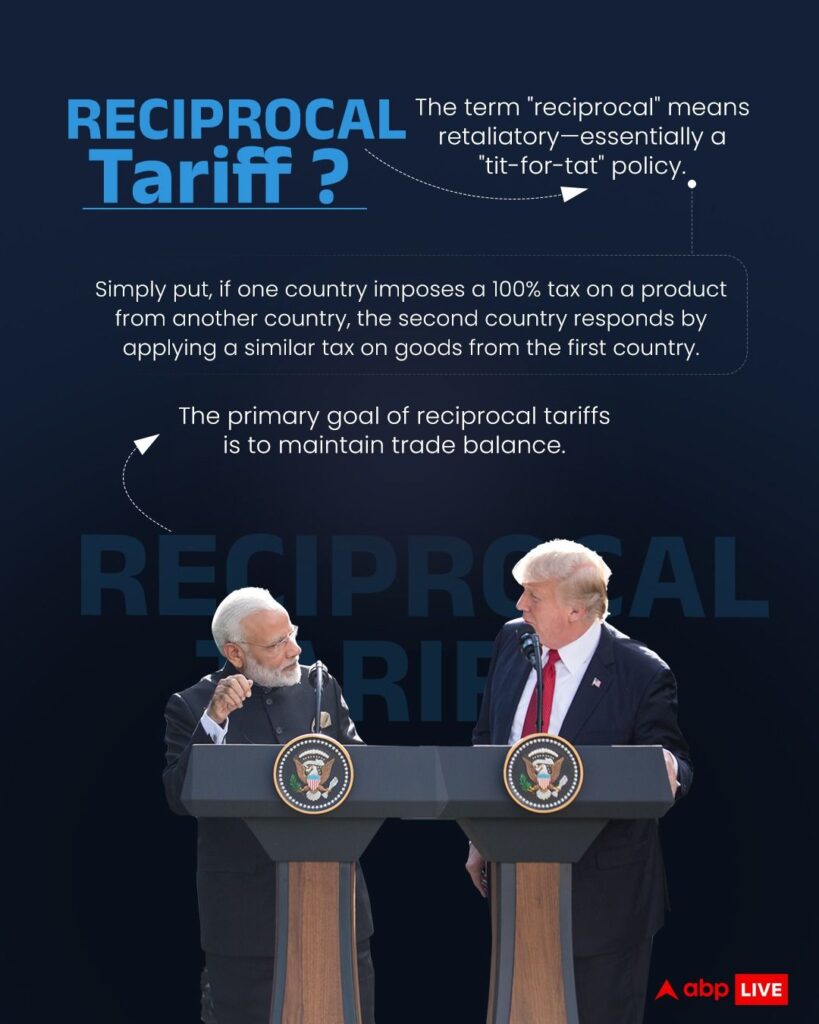

They vary based on:

• Product type (e.g., cotton rugs, macrame, jute mats, cushion covers)

• Destination country (U.S., U.K., EU markets, etc.)

• Trade agreements between countries

⸻

Why Tariffs Matter in Textile Exports

For exporters such as More Textiles, understanding tariffs is essential because they directly influence:

1. Export Pricing: Tariffs increase costs, affecting international competitiveness.

2. Profit Margins: Exporters need to adjust prices or optimize production.

3. Market Access: Trade agreements offering tariff concessions open new markets.

4. Supply Chain Planning: Knowledge of tariff structures helps select profitable destinations.

⸻

Textile Tariff Trends in 2025

Here are the major trends shaping textile export tariffs in 2025:

• Sustainability Incentives: Many countries are offering lower tariffs for eco-friendly or organic textiles.

• Digital Trade Compliance: Exporters must now comply with new customs automation systems.

• Regional Trade Deals: India is finalizing trade agreements with the EU and UAE to enhance export benefits.

• Post-Pandemic Adjustments: Tariffs previously reduced during COVID-19 are being revised.

⸻

How to Check Applicable Tariffs

To find your textile product’s tariff rates:

1. Use HS Codes (Harmonized System Codes): Identify your product’s HS code.

2. Check Official Trade Portals:

• India: DGFT – Directorate General of Foreign Trade

• USA: USITC Tariff Database

• EU: TARIC Database

3. Consult Experts: Partner with experienced exporters like More Textiles or freight forwarders for up-to-date tariff information.

⸻

Tips to Minimize Tariff Costs

Exporters can take several smart steps to reduce costs:

• Utilize Free Trade Agreements (FTAs): Check if your target country offers tariff concessions.

• Adopt Sustainable Practices: Eco-certified textiles often receive tariff benefits.

• Optimize Shipment Planning: Consolidate shipments to save on customs charges.

• Stay Connected with Trade Councils: Chambers of commerce and export promotion councils share tariff updates.

- Common Challenges for Textile Exporters

- 1. Complex documentation and classification of goods.

- 2. Frequent policy updates affecting trade routes.

- 3. Hidden costs like freight surcharges and customs fees.

- 4. Currency volatility influencing landed costs.

More Textiles stays ahead of these challenges by maintaining an in-house compliance team and continuously monitoring tariff regulations for each export market.

Future of Textile Export Tariffs

The coming years will see stronger alignment with sustainability standards, digitized trade systems, and AI-driven customs checks. Exporters who stay updated — like More Textiles — will enjoy a clear competitive advantage in global trade.

⸻

Conclusion

Textile export tariffs are a crucial part of international business success. By staying informed about tariff updates, trade agreements, and sustainability-linked incentives, exporters can protect profits and grow globally.

More Textiles, one of India’s leading manufacturers and exporters of home décor textiles, continues to empower businesses worldwide with high-quality products and expert trade insights.